Stable Money is a real investment platform in India that offers investments in fixed deposits (FDs) and bonds.

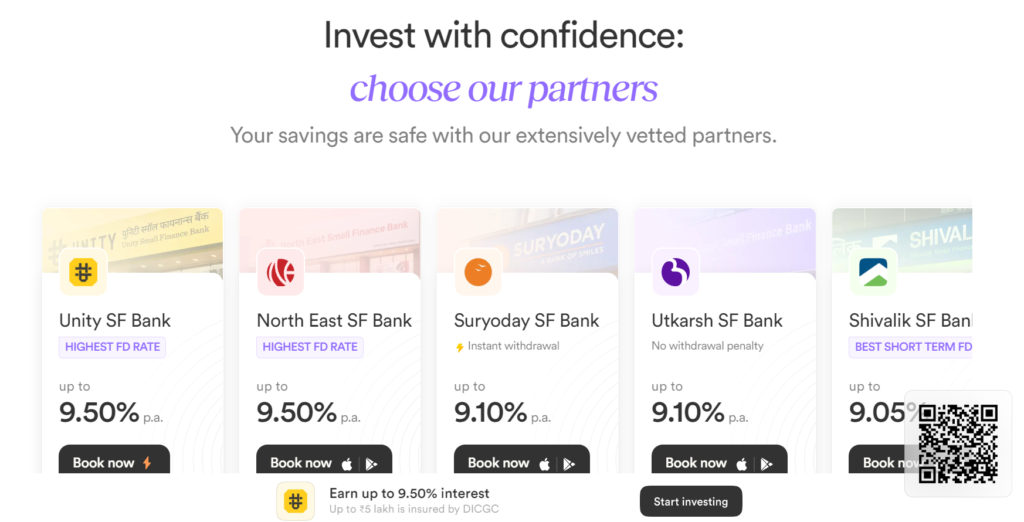

It partners with RBI-regulated banks and Non-Banking Financial Companies (NBFCs), to ensure the safety of investments and to protect the interests of investors.

Through Stable Money, Investments in bank FDs are insured up to ₹5 lakh by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which is a subsidiary company of RBI

Stable Money also ensures the safety of its user’s personal and financial transaction data and follows industry-standard practices to maintain the security of its user information.

Stable Money also offers the facility of instant withdrawal and a no-lock period in FDs making it an attractive investment choice for investors.

Disclaimer – The above information is provided after conducting research from different sources and should not be taken as financial advice.

Feel free to download Stable Money from here – Download Link

Check out this post from our blog – How does Stable Money Make Money? Stable Money FD Rates

[…] Check out this post from our blog: Stable Money Review: Is Stable Money Real or Fake? A Complete Analysis […]